- Behind The Brand

- Posts

- Case Study: David(Protein Bar)

Case Study: David(Protein Bar)

The ‘Protein Cheat Code’ That Turned a Science Ingredient Into a Moat

Why was that company unique, and what made them stand out?

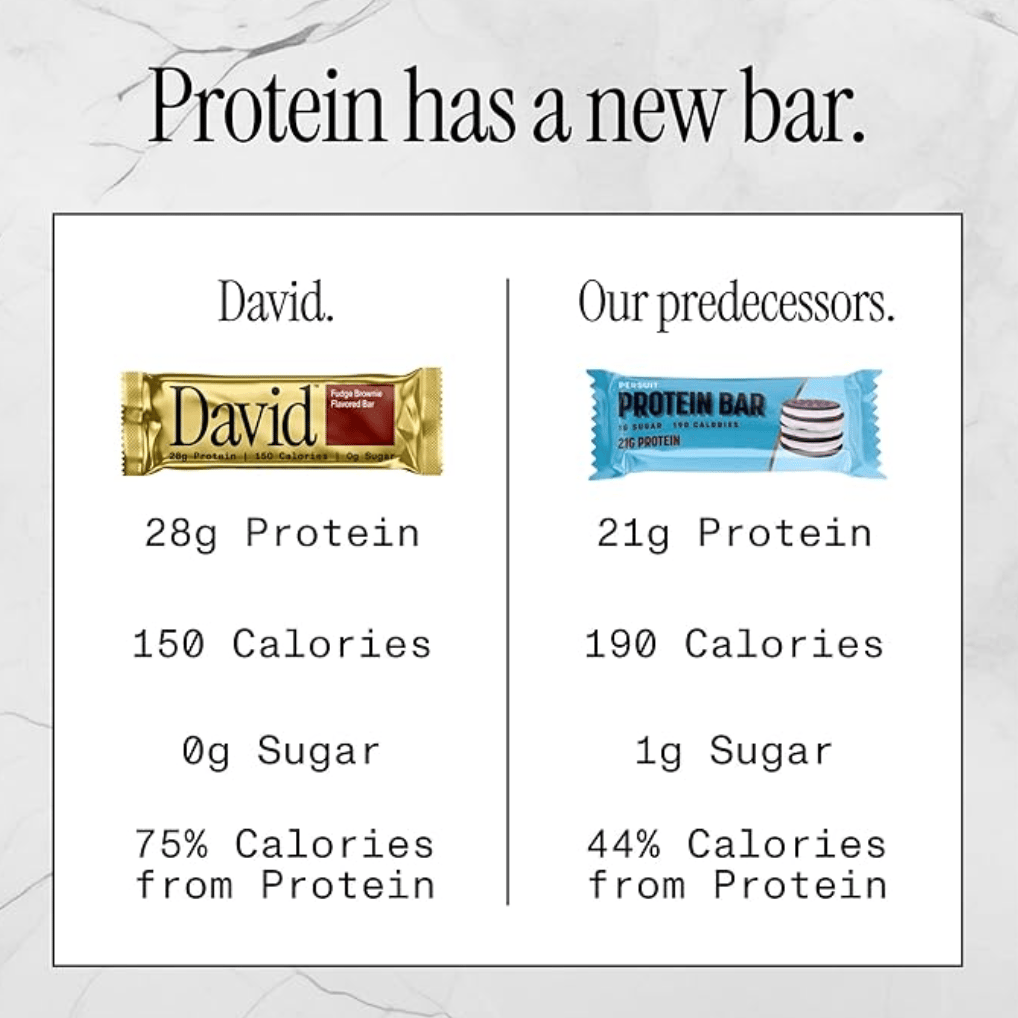

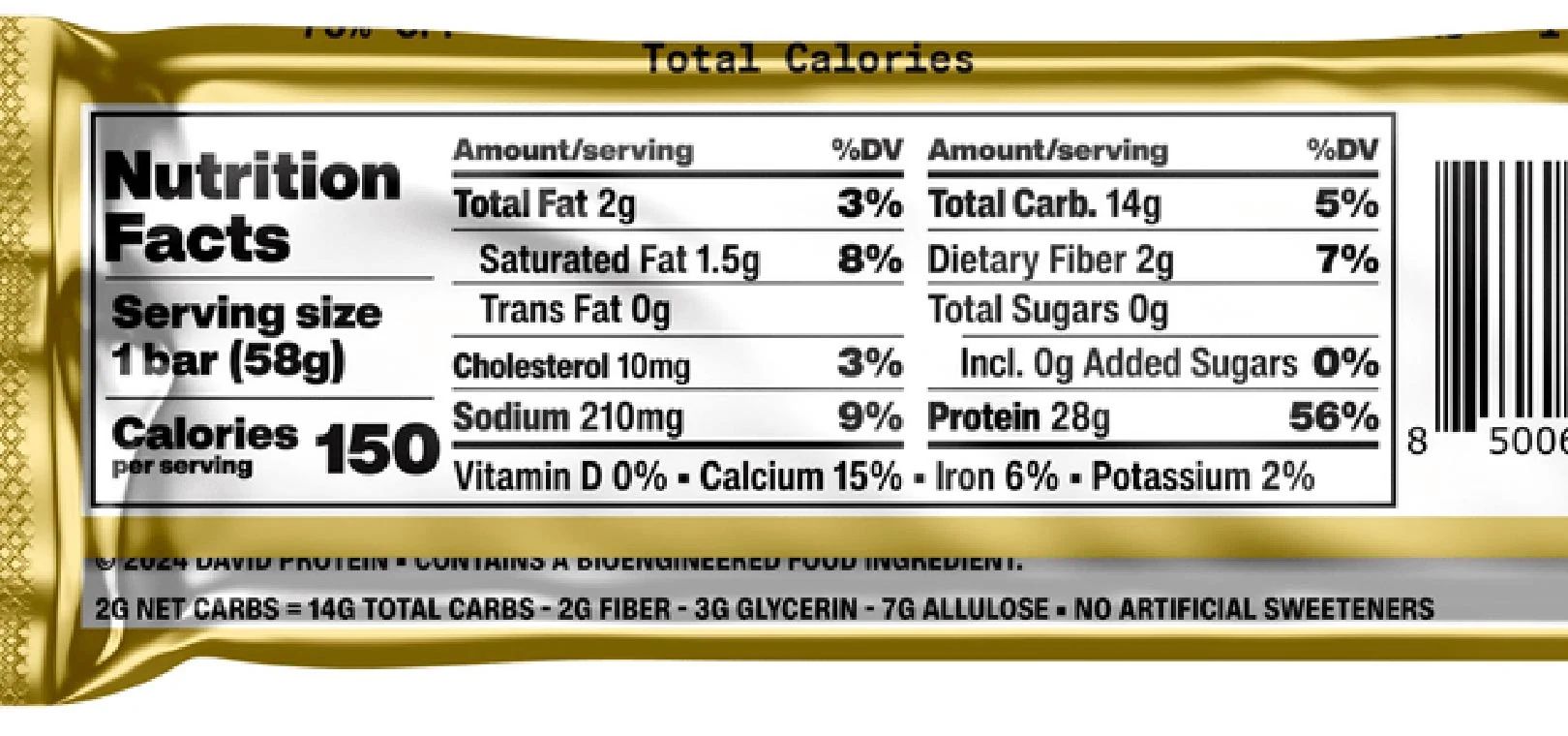

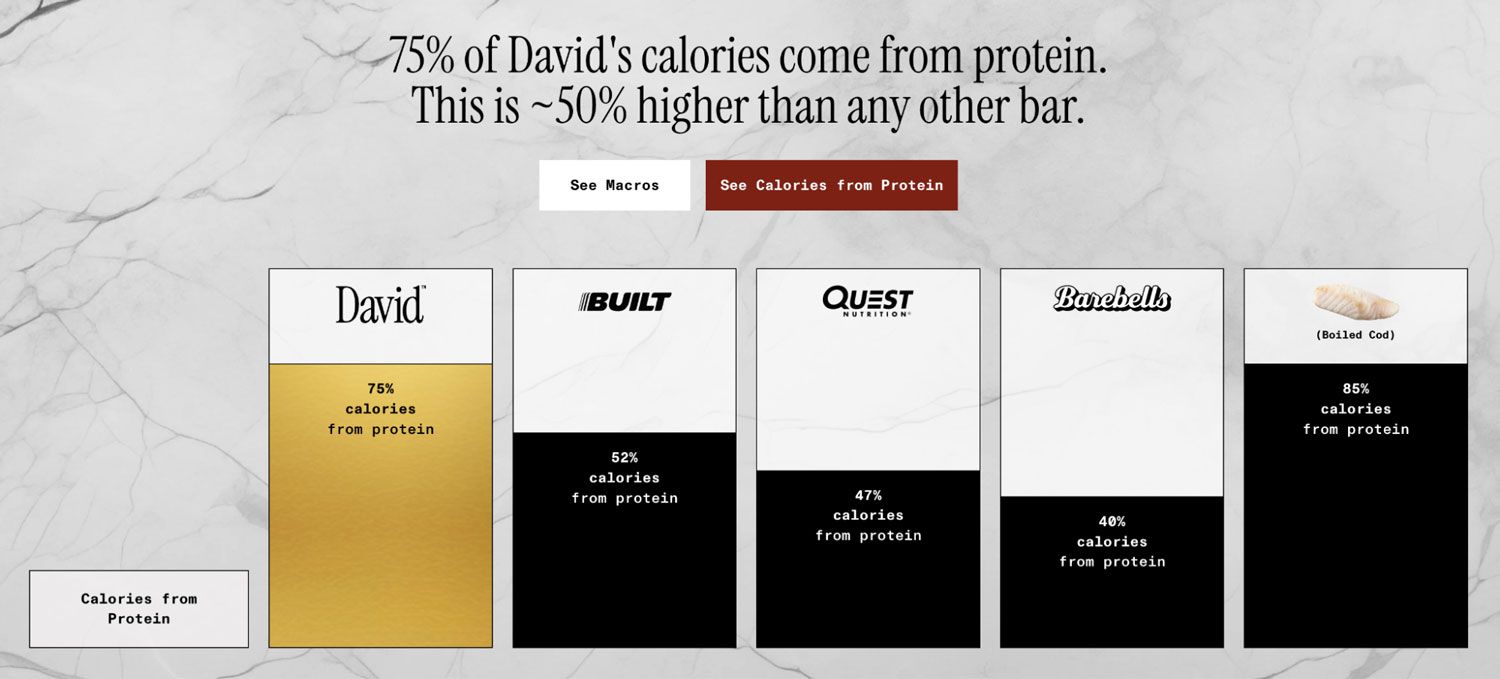

David didn’t win by inventing “another protein bar.” It won by engineering a macro profile that felt almost impossible: 28g protein for ~150 calories—a ratio that made the product instantly discussable, screenshot-able, and “too good to be true” in a category where tradeoffs are expected.

The unlock was EPG (esterified propoxylated glycerol)—a fat substitute that can deliver fat-like texture with far fewer calories. David used EPG as the “secret sauce” to improve mouthfeel while protecting the macro math, and then built the entire brand story around being the best protein-per-calorie option on the market.

Then David did something even rarer: it didn’t just use EPG—it moved to control it. In May 2025, David acquired Epogee, a key supplier/maker associated with EPG, triggering allegations from other brands that David was attempting to monopolize access to the ingredient.

Their detailed marketing strategy

1) “Protein-per-calorie” as a viral metric (not a slogan)

David markets a number people can instantly compare. That ratio drives organic debate (“Is this real?”), which is rocket fuel for shares, stitches, and gym/health communities.

2) The Cod campaign as cultural judo (product + satire + positioning)

David launched a wild-caught Pacific cod product—priced premium—and framed it as a tongue-in-cheek flex: cod is one of the few foods with an even better protein-to-calorie ratio than their bars. The move worked as a campaign because it:

reinforced the “macro optimization” obsession,

baited critics into talking about David,

and expanded the brand from “bar company” to “high-protein platform.”

|  |

3) Influencer science credibility + performance codes

David leaned into trusted health/optimization voices and code-driven acquisition. Commentary around early growth highlights large waitlists and strong first-week sales, boosted by prominent endorsements and a tight narrative around “engineering” the ideal bar.

4) Ambassador/affiliate infrastructure

The brand runs an ambassador program that pays commission on first purchases—turning customers and creators into a scalable distribution channel.

5) Ingredient control as a strategic moat (and controversy engine)

After acquiring Epogee, David became central to an industry fight over EPG supply. Multiple reports describe lawsuits and claims that other companies were cut off or pressured around supply terms—turning an ingredient into both a competitive advantage and a headline.

How can other business owners use/implement this in their business?

1) Market a “proof point,” not a vibe

Pick a metric customers can repeat in one breath (protein/calorie, minutes saved, dollars saved). Make your marketing a comparison.

2) Turn criticism into content (the Cod playbook)

If your brand has a core obsession, exaggerate it into a campaign people can’t ignore. The cod stunt didn’t need to be huge revenue—its job was attention + reinforcement of the brand thesis.

3) Build distribution via incentives, not only ads

Affiliate/ambassador programs create compounding reach. Make it easy: clear commission rules, first-purchase payouts, swipeable assets.

4) Own a unique input—but don’t underestimate the risk

If your edge comes from a specialized ingredient, supply chain, or method: protect it (contracts, IP, partnerships). But understand the reputational and legal risk if competitors depend on it too—David’s EPG story became a major public fight.

Takeaways

David’s growth is engineered around a single, repeatable claim (protein-per-calorie) that travels fast in health communities.

EPG is the functional differentiator that helps the bar hit the macro math while keeping texture—its GRAS history is documented in FDA materials.

The Cod campaign is a masterclass in brand theater: a product release that doubles as a positioning statement.

The Epogee acquisition turned differentiation into defensibility—and sparked allegations of monopolization that now shape public perception of the brand.

The meta-lesson: in modern CPG, the best brands don’t just sell products—they build systems (metric-led narrative + content loops + distribution programs + supply advantage).